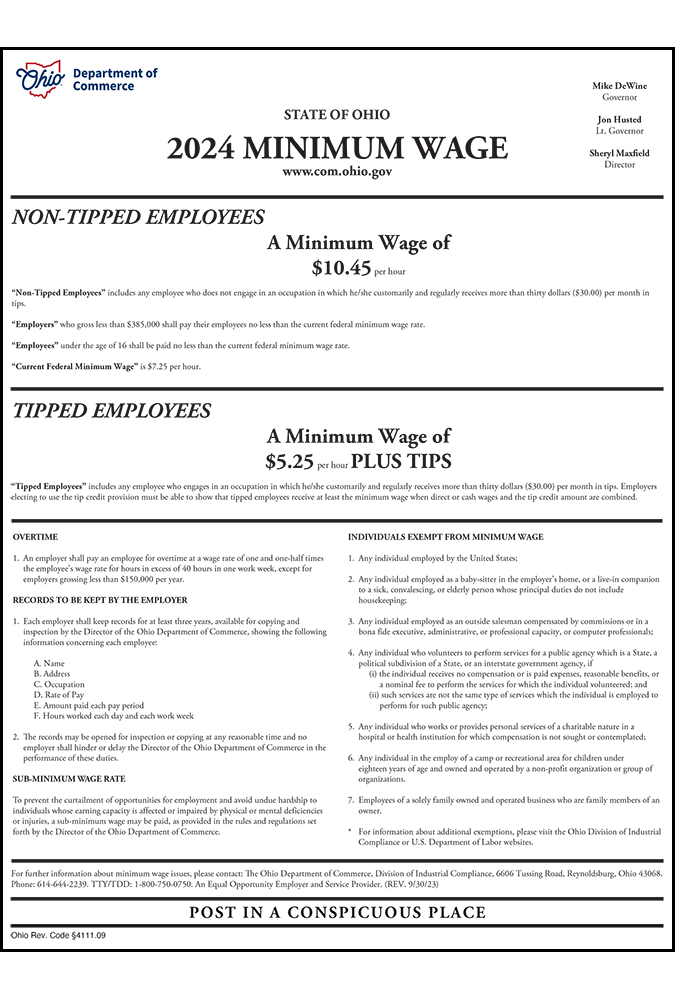

Ohio Exempt Salary Threshold 2024. Ohio’s minimum wage is going up in 2024; The 2023 ohio minimum wage.

Ohio’s minimum wage is going up in 2024. To qualify as an exempt employee in ohio, individuals must meet a minimum salary threshold set by federal law.

The Current Salary Threshold For Exempt Status For Executive, Administrative, And Professional (Eap) Positions Is $684 Per.

Ohio’s minimum wage is going up in 2024.

Ohio State Income Tax Tables In 2024.

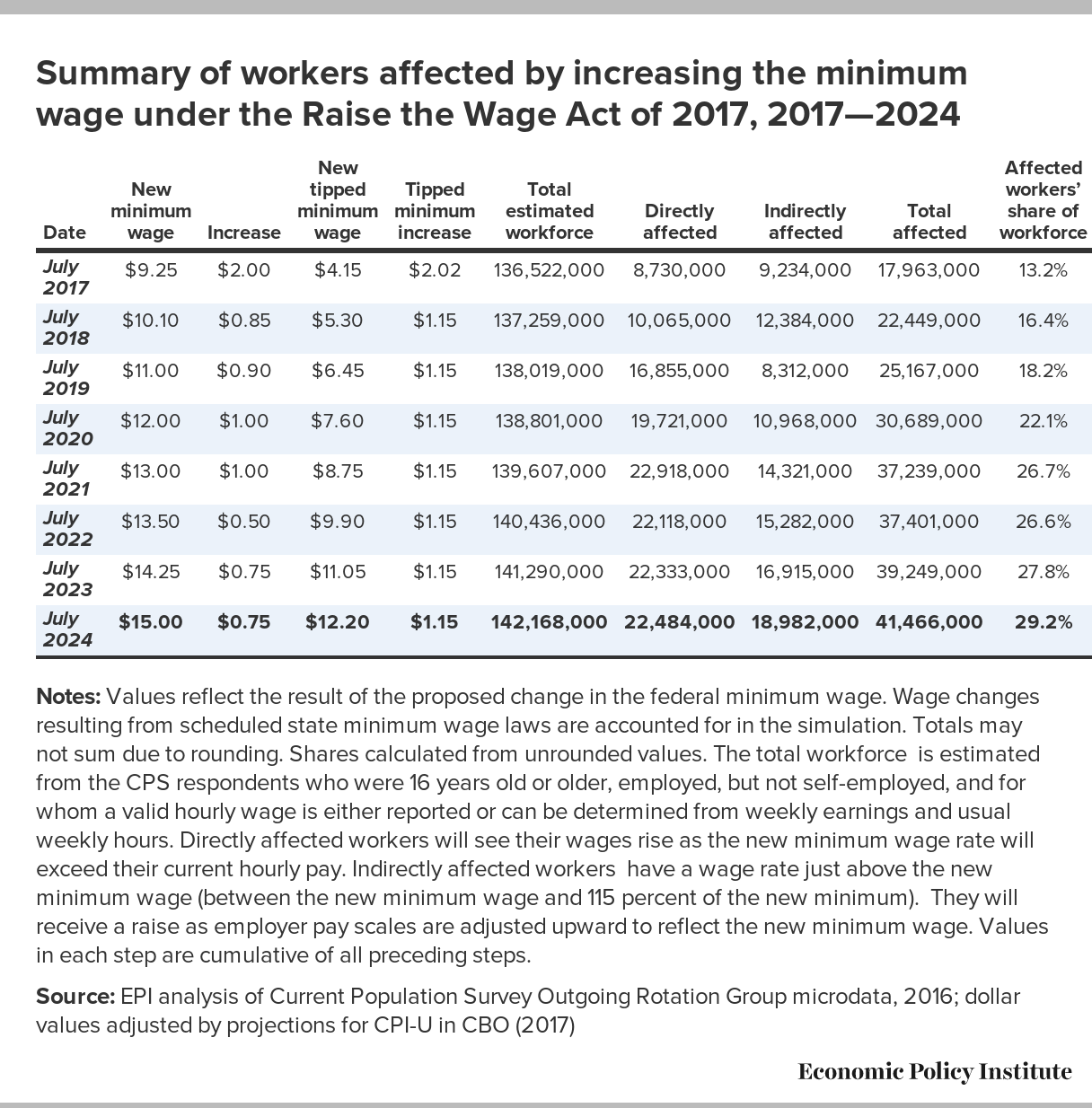

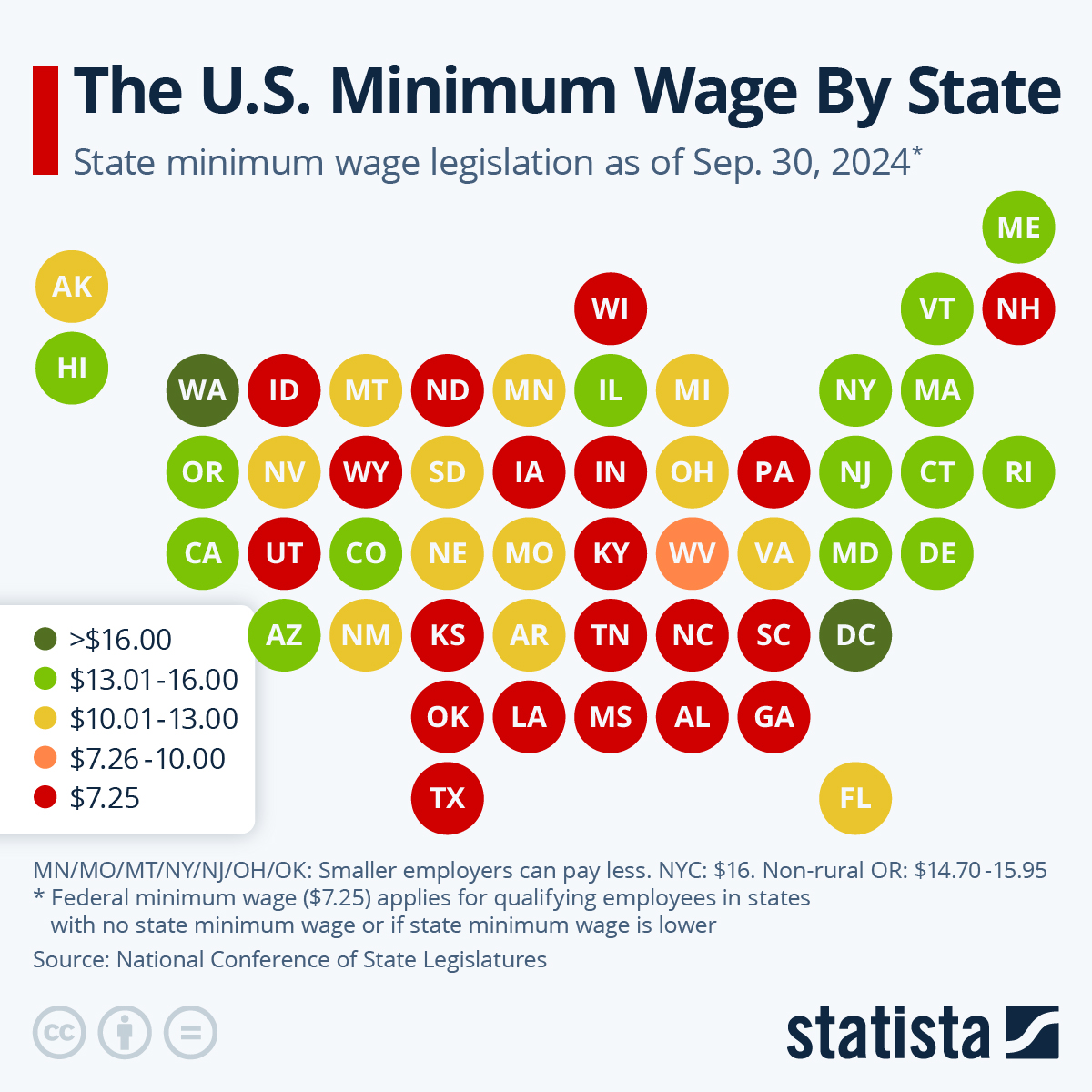

Raising the minimum wage to 15 by 2024 would lift wages for 41 million, that minimum remained flat for 2024, but the u.s.

The 2023 Ohio Minimum Wage.

Images References :

Source: www.epi.org

Source: www.epi.org

Raising the minimum wage to 15 by 2024 would lift wages for 41 million, 2024 exempt status salary threshold by city and state. Due to new changes in ohio overtime laws, the threshold to meet the salary basis test has increased.

Source: shanieoeilis.pages.dev

Source: shanieoeilis.pages.dev

Minimum Wage In Ohio 2024 Per Hour Gwyn Portia, Exempt employees in ohio must meet this salary threshold and satisfy specific job duties tests to be considered exempt from overtime pay. In washington state, the salary threshold exemption is $1,302.40/week ( $67,724.80 a year) for 2024.

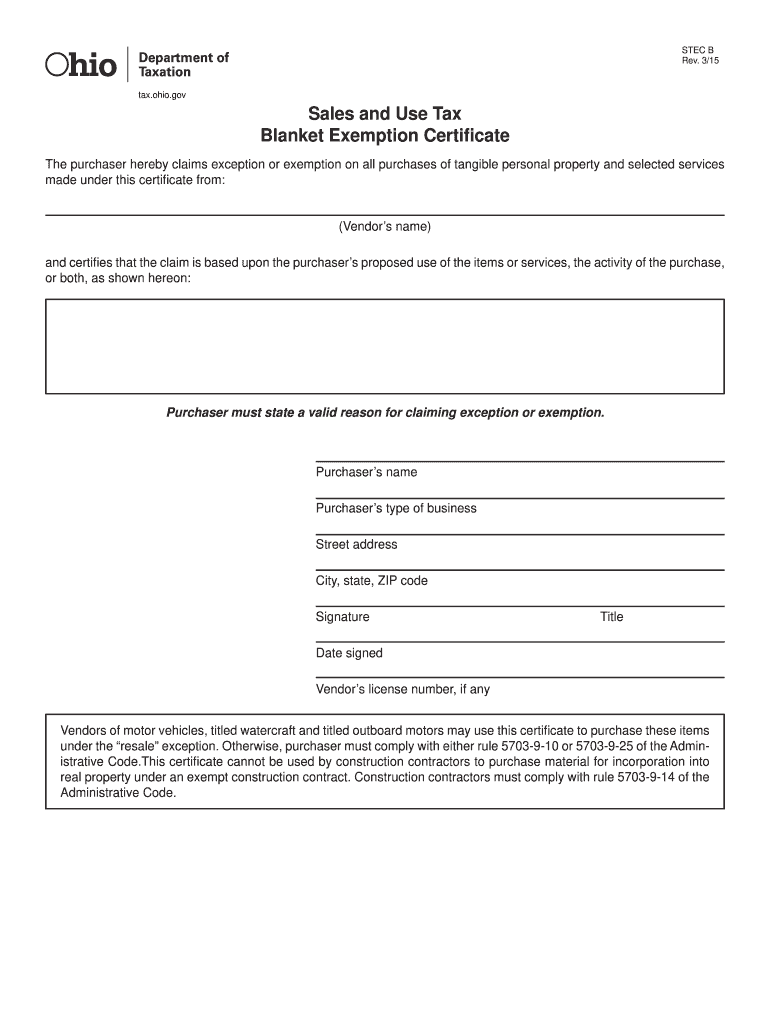

Source: www.dochub.com

Source: www.dochub.com

Ohio tax exempt form Fill out & sign online DocHub, © provided by wcmh columbus. This is what we can glean now from the dol’s nprm:

Source: www.vidahr.com

Source: www.vidahr.com

2023 Exempt Status Salary Threshold by City and State, The proposed regulation, if accepted as a revision to existing dol regulation 29 cfr part 541 defining overtime eligibility, would increase the weekly required. As a reminder, and as explained in our previous blog post, the dol has proposed the threshold salary level for exemption from overtime be raised from.

![Social Security Wage Base 2021 [Updated for 2023] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png) Source: www.uzio.com

Source: www.uzio.com

Social Security Wage Base 2021 [Updated for 2023] UZIO Inc, Dol proposes new exempt salary threshold to start in 2024. Now, an employee must be paid on a salary basis of no.

Source: www.dochub.com

Source: www.dochub.com

Ohio tax exempt form Fill out & sign online DocHub, Ohio’s minimum wage is going up in 2024. In washington state, the salary threshold exemption is $1,302.40/week ( $67,724.80 a year) for 2024.

Source: cmmllp.com

Source: cmmllp.com

2024 Changes to Minimum Wage and Overtime Exempt Salary Threshold, The final rule is expected in april, 2024. Exempt employees in ohio must meet this salary threshold and satisfy specific job duties tests to be considered exempt from overtime pay.

Source: www.timeequipment.com

Source: www.timeequipment.com

DOL Proposes New Exempt Salary Threshold To Start In 2024, The current salary threshold for exempt status for executive, administrative, and professional (eap) positions is $684 per. The salary threshold would increase from the current $684 per week ($35,568 per year) to $1,059 per week ($55,068 per year)—a 55% increase from the.

Source: livaqgeorgena.pages.dev

Source: livaqgeorgena.pages.dev

New York State Minimum Salary Exempt 2024 dinah elbertina, To view a pay rate table and/or longevity table, select the link. As a reminder, and as explained in our previous blog post, the dol has proposed the threshold salary level for exemption from overtime be raised from.

Source: elchoroukhost.net

Source: elchoroukhost.net

2017 Federal Withholding Wage Bracket Tables Elcho Table, Dol proposes new exempt salary threshold to start in 2024. The current salary threshold for exempt status for executive, administrative, and professional (eap) positions is $684 per.

What Salary Amount Is High Enough For An Employee To Be Considered “Exempt”?

The proposed regulation, if accepted as a revision to existing dol regulation 29 cfr part 541 defining overtime eligibility, would increase the weekly required.

2024 Exempt Status Salary Threshold By City And State.

Are you eligible to earn it?